If you're an adult with kids, then you know that life can be pretty hectic. Between juggling work, taking care of your children, and trying to find time for yourself, it can be tough to focus on repairing your credit. But it's important to do so! Your credit score is a key factor in determining your financial future. In this blog post, we will discuss some tips for repairing your credit while you're parenting!

Don't apply for too many credit cards at once

Applying for multiple credit cards in a short period of time can actually hurt your credit score. That's because each time you apply for a new card, the lender will do a hard inquiry on your credit report. Too many hard inquiries can signal to lenders that you're desperate for credit, which can lead them to believe you're a higher risk borrower.

Additionally, each hard inquiry will stay on your credit report for up to two years, so if you're planning on applying for a mortgage or another loan in the near future, or you’re having a hard time getting into car loans for bad credit, it's best to space out your credit applications. If you're trying to repair your credit, there are plenty of other things you can do that won't involve applying for new credit cards. Check your credit report for errors and dispute any mistakes you find. If you have outstanding debt, focus on paying it down as much as possible.

And finally, make sure you always pay your bills on time - this is one of the most important factors in determining your credit score. By following these steps, you can rebuild your credit without harming your chances of getting approved for future loans.

Establish a budget and stick to it

Any parent knows that kids can be expensive. Between diapers, clothes, food, and activities, the costs of raising a child can quickly add up. That's why it's so important to establish a budget and stick to it. By setting spending limits for each category, you can avoid overspending and stay on track financially.

However, this can be easier said than done when you have kids. Children are always growing and changing, which means their needs are constantly changing as well. And let's face it, kids can be persuasive! It can be hard to say no when your child is begging for the latest toy or gadget.

But if you want to stay within your budget, it's important to be firm. Explain to your child why it's important to stick to the budget, and offer alternative activities that are less expensive. With a little effort and discipline, you can maintain a budget that works for your family.

Pay your bills on time, every time

One of the best ways to improve your credit score is to pay your bills on time, every time. This includes both your monthly credit card payments as well as any other recurring bills, such as utilities or rent. While paying your bills on time won't necessarily raise your credit score, it will keep it from going down. And, over time, a consistently good payment history will start to have a positive impact on your score.

Additionally, by paying your bills on time you'll avoid late fees and other penalties, which can add up quickly and further damage your credit. So if you're looking to repair your credit, make sure you pay your bills on time - it's one of the simplest and most effective things you can do.

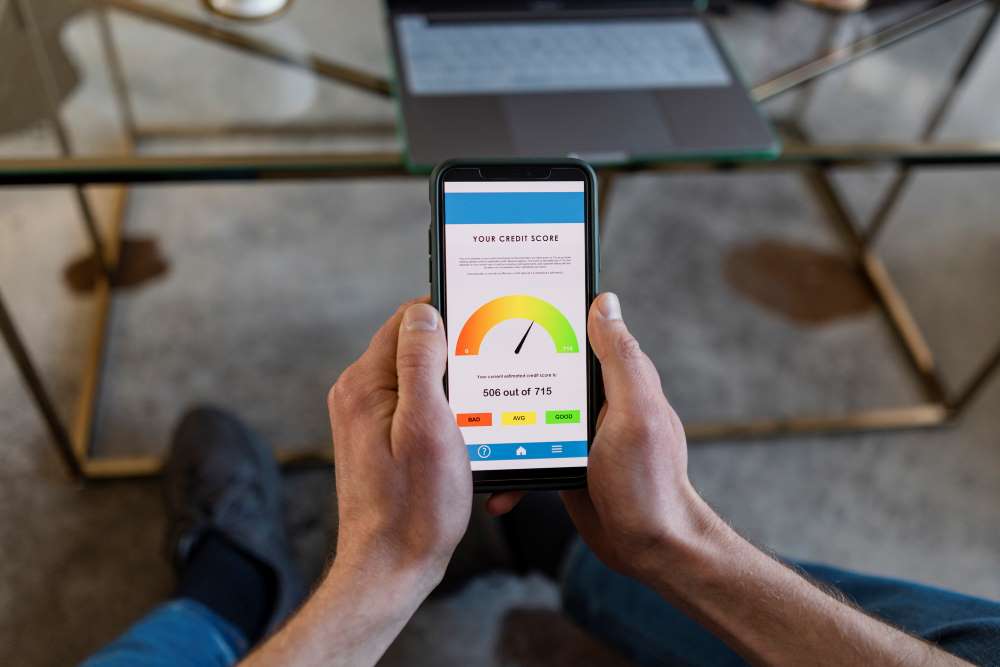

Keep an eye on your credit score - you can get a free report from AnnualCreditReport.com

Credit scores are important. A good credit score can get you a lower interest rate on a loan, help you rent an apartment, and even get you a job. A bad credit score can make it hard to do all of those things. That's why it's important to keep an eye on your credit score and take steps to repair your credit if it's not where you want it to be.

There are a few things you can do to help repair your credit score. First, make sure you make all of your payments on time. Second, use less than 30% of your available credit. Third, keep old debt and inactive accounts open. Following these tips can help you improve your credit score over time.

Try to pay off your debts as quickly as possible

Your credit score is important. It's a number that lenders look at to determine whether or not you're a good candidate for a loan. A high credit score means you're seen as being low-risk, and you're more likely to be approved for a loan with a favorable interest rate. A low credit score, on the other hand, could make it difficult to get a loan at all.

If you're looking to improve your credit score, one of the best things you can do is pay off your debts as quickly as possible. This shows lenders that you're responsible with your money and capable of repaying what you owe. So if you're carrying any debt, make paying it off a priority. Your credit score will thank you for it in the long run.

Conclusion

There are a few things you can do to help repair your credit score. Paying your bills on time is one of the most important factors in determining your credit score. Additionally, by paying your bills on time you'll avoid late fees and other penalties, which can add up quickly and further damage your credit. Another way to help improve your credit score is to keep an eye on your credit report and dispute any errors you find. Additionally, try to pay down your debts as quickly as possible. By following these steps, you can improve your credit score over time.